In the wake of the Great Depression and WWII, employers started to add benefits packages. Healthcare had fallen by the wayside for families working to access the basic necessities of life. The idea was to support the employee’s personal needs while keeping and attracting the best talents in the workforce. This trend of offering benefits has continued into the 21st century. In the present era, most employees that join the workforce are Millennials (born between 1981-1996) and Generation Z (born between 1997-2012). Over half of them have said they want help building a more secure financial future. Over half of them have said they want help building a more secure financial future.

In the wake of the Great Depression and WWII, employers started to add benefits packages. Healthcare had fallen by the wayside for families working to access the basic necessities of life. The idea was to support the employee’s personal needs while keeping and attracting the best talents in the workforce. This trend of offering benefits has continued into the 21st century. In the present era, most employees that join the workforce are Millennials (born between 1981-1996) and Generation Z (born between 1997-2012). Over half of them have said they want help building a more secure financial future. Over half of them have said they want help building a more secure financial future.

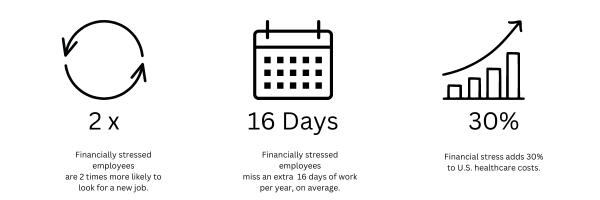

Employee benefits play a crucial role in providing financial safety nets for employees. When employees experience less financial stress, employers see better employee productivity and fewer work absences. To aid with financial guidance and resources, many employers are offering financial wellness benefits beyond typical retirement plans. Here are some common financial safety nets that may be included in employee benefit packages:

- Retirement Plans: Employer-sponsored retirement plans, such as 401(k) or pension plans, enable employees to save for their post-employment years. These plans typically offer contributions from both the employer and employee, providing a safety net for financial stability during retirement.

- Disability Insurance: Disability insurance provides income replacement if an employee becomes unable to work due to a disability. It helps protect against loss of income during an extended period of absence from work. More disabilities are caused by illness rather than injury – including common conditions like heart disease, back pain or arthritis.

- Life Insurance: Life insurance offers financial protection to employees’ beneficiaries in the event of their death. It provides a lump sum payment or regular income to dependents, helping them cope with financial obligations.

- Paid Time Off (PTO): Paid leave policies, such as vacation days, sick leave, and personal days, offer employees the flexibility to take time off while still receiving their regular pay. This benefit supports employees during times of illness, personal emergencies, or the need for work-life balance.

- Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs): FSAs and HSAs allow employees to set aside pre-tax dollars for qualified healthcare expenses or dependent care expenses. These accounts reduce the financial burden of medical or childcare costs.

- Tuition Reimbursement or Assistance Programs: Realizing student loans burden many employees, a growing number of employers are willing to offer help. Employers may also offer educational assistance programs to help employees pursue further education or skill development.

- Financial Education and Counseling: Employers may provide financial education programs and counseling services to help employees manage their finances effectively. Financial planning provides access to financial advisors who can help employees develop an overall financial plan including retirement savings and investing. Financial coaching helps employees manage their personal finances, such as budgeting and managing credit.

- Employee Assistance Programs (EAP): EAPs offer confidential counseling, mental health support, and resources to employees and their families. These programs help employees address personal and work-related challenges and promote overall well-being.

It’s important to note that the specific benefits offered by employers can vary widely. When it comes to benefits, employers know the cost of providing the best options pays off with better talent and more productive workers. Ultimately, having some financial safety nets in place for employees helps workers achieve their financial goals and save more of their hard-earned money for both expected and unexpected expenses.