Are you the type of person who loves to save money? You’ll be happy to know that there’s a way to do so with your health care costs. It starts with medical expense accounts which let you set aside money to pay for certain health products and services. One type of medical expense account is a Health Savings Account (HSA).

Are you the type of person who loves to save money? You’ll be happy to know that there’s a way to do so with your health care costs. It starts with medical expense accounts which let you set aside money to pay for certain health products and services. One type of medical expense account is a Health Savings Account (HSA).

How Does An HSA Work?

An HSA is a type of personal savings account you can use to pay certain health care costs. An HSA lets you pay for qualified health, dental and vision care costs for yourself, spouse and dependents with tax-free money. The money you contribute comes out of your paycheck – before taxes – and that is how you save to pay for your out-of-pocket health care expenses. Like a regular savings account, your HSA has an interest rate that allows your money to grow while sitting in the account. Your employer also has the option of contributing to your HSA, helping it to grow faster.

If you don’t use all of your HSA funds during the calendar year, you can roll that money over. An HSA is owned by you so you take it with you no matter if you change plans, change jobs or if you decide to retire. You will get a debit card which is linked to your HSA when you set up your account that you use to pay for eligible expenses.

You must be enrolled in a High Deductible Health Plan (HDHP) to open and contribute to an HSA. HDHPs medical plans aim to minimize your health care costs if you don’t use your plan a lot but keep you financially protected in cases of illness or emergency. Similar to a car insurance policy, you pay for your expenses up to the point that you meet your deductible and then the insurance coverage begins. The higher the deductible you choose, the smaller the monthly cost will be. But it also means that when you have health expenses, you are responsible for all of the costs up to your deductible amount. Rather than pay for your health expenses that occur before hitting your deductible out of your pocket, you can pay for those expenses using pre-tax dollars from your HSA account.

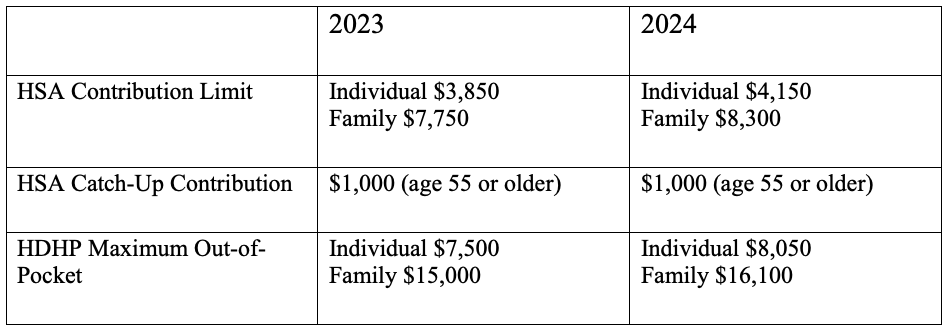

Federal law includes strict guidelines for HSAs including HDHP cost sharing and annual limits on contributions. The amount you contribute can be adjusted throughout the year but they do have an annual limit on how much you can contribute per year. This limit is set by the IRS and usually increases each year. Contribution limits for 2023 and 2024 are:

What Are the Benefits of Having an HSA?

- Money goes in tax-free – Your HSA contributions are made on a pre-tax basis and are also tax deductible

- Money comes out tax-free – Eligible healthcare purchases can be made directly from the HSA account

- Earn interest, tax-free – The interest on HSA funds grows on a tax-free basis. Unlike most savings accounts, interest earned on an HSA is not considered taxable income when funds are used for eligible medical expenses.

- Your HSA balance can be invested – Depending on your HSA, you may be eligible to invest your HSA similar to a 401k or IRA – in an interest-bearing account, mutual fund, stocks or bonds.

- Your HSA balance can be carried over – Unlike a Flexible Spending Account (FSA), an HSA is not a use-it-or-lose-it account. You can carry over your balance year after year.

- You can use your HSA to add to your retirement funds – After the age of 65, you can withdraw funds from your HSA for any reason without penalty.

The Bottom Line

HSAs are often referred to as triple tax-advantaged and are one of the best savings and investment tools available under the U.S. tax code. As a person ages, medical expenses tend to increase, particularly when reaching retirement age and beyond. Therefore, starting an HSA early and allowing it to accumulate over a long period, can contribute greatly to securing your financial future.